The 4-Minute Rule for Guided Wealth Management

Table of ContentsMore About Guided Wealth ManagementSome Known Incorrect Statements About Guided Wealth Management The Ultimate Guide To Guided Wealth ManagementThe smart Trick of Guided Wealth Management That Nobody is DiscussingNot known Factual Statements About Guided Wealth Management

Be alert for feasible conflicts of rate of interest. The expert will set up a possession allocation that fits both your risk resistance and threat capacity. Property appropriation is simply a rubric to determine what percentage of your total financial portfolio will be dispersed throughout numerous asset classes. A more risk-averse individual will have a higher focus of federal government bonds, deposit slips (CDs), and cash market holdings, while a person who is even more comfortable with risk may make a decision to handle more stocks, business bonds, and maybe also investment realty.

The average base wage of an economic expert, according to Certainly since June 2024. Note this does not consist of an approximated $17,800 of annual payment. Anyone can work with a monetary advisor at any kind of age and at any phase of life. wealth management brisbane. You do not have to have a high total assets; you just have to find an expert fit to your circumstance.

Unknown Facts About Guided Wealth Management

Financial consultants function for the client, not the company that employs them. They should be receptive, eager to clarify economic concepts, and keep the client's finest rate of interest at heart.

A consultant can suggest possible enhancements to your plan that may assist you accomplish your goals better. If you do not have the time or passion to handle your finances, that's another good factor to hire a financial advisor. Those are some general reasons you could require an expert's professional assistance.

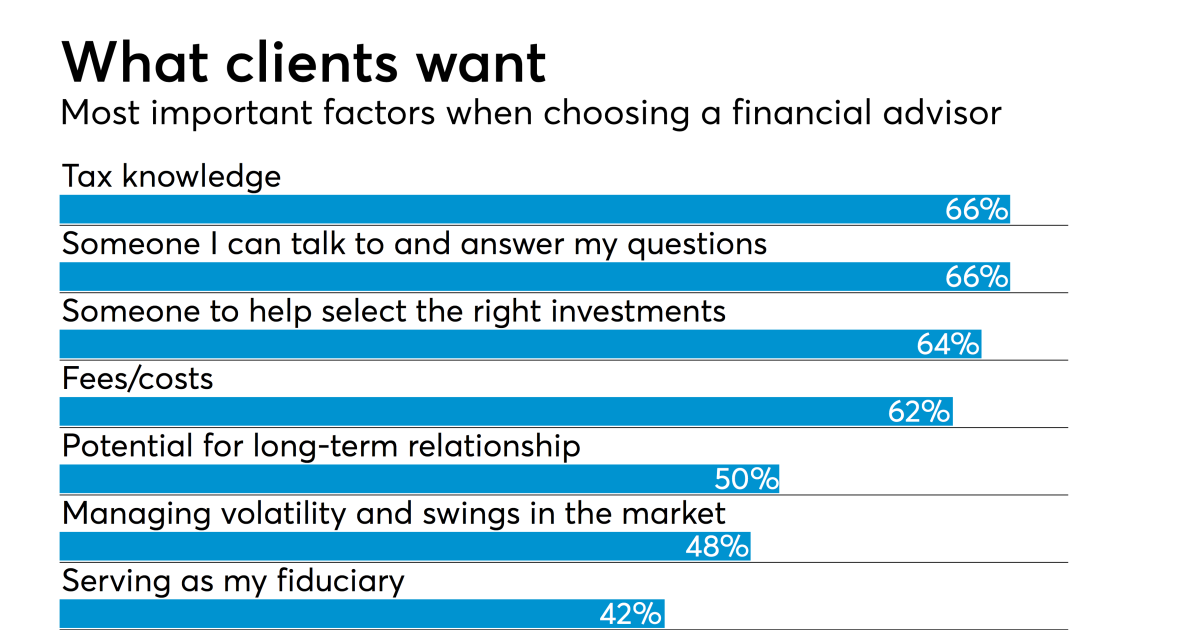

Seek a consultant who focuses on educating. An excellent economic advisor should not simply offer their services, however give you with the tools and sources to come to be financially smart and independent, so you can make enlightened decisions on your very own. Look for an advisor who is educated and well-informed. You want an advisor that stays on top of the financial scope and updates in any kind of location and that can answer your economic questions regarding a myriad of topics.

Little Known Facts About Guided Wealth Management.

Others, such as certified economic planners(CFPs), currently stuck to this requirement. Under the viability criterion, financial consultants normally function on commission for the items they sell to customers.

Charges will certainly also vary by area and the advisor's experience. Some experts may offer reduced rates to help customers that are simply getting going with economic planning and can not pay for a high regular monthly price. Generally, an economic advisor will use a totally free, preliminary consultation. This examination offers a chance for both the customer and the consultant to see if they're an excellent suitable for each other - https://www.pubpub.org/user/brad-cumner.

A fee-based consultant may gain a cost for developing an economic plan for you, while additionally earning a payment for marketing you a specific insurance policy product or investment. A fee-only economic consultant gains no compensations.

Guided Wealth Management for Beginners

Robo-advisors don't need you to have much cash to get started, and they set you back much less than human monetary experts. A robo-advisor can't talk with you about the ideal means to obtain out of financial debt or fund your child's education and learning.

An expert can help you find out your financial savings, just how to build for retirement, aid with estate preparation, and others. If nevertheless you just need to go over profile allowances, they can do that as well (usually for a charge). Financial experts can be paid in a number of methods. Some will certainly be commission-based and will certainly make a percent of the items they steer you right into.

Some Known Questions About Guided Wealth Management.

Marital relationship, divorce, remarriage or simply relocating with a new companion are all milestones that can require careful preparation. For circumstances, along with the often difficult psychological ups and downs of divorce, both companions will need to take care of important economic considerations (https://anotepad.com/note/read/m8f48e66). Will you have sufficient income to support your way of living? Exactly how will your investments and various other possessions be divided? You may quite possibly require to change your financial strategy to keep your objectives on course, Lawrence states.

An abrupt influx of cash or possessions elevates immediate inquiries concerning what to do with it. "A financial advisor can assist you think with the ways you can put financial advice brisbane that cash to function toward your personal and economic objectives," Lawrence says. You'll wish to think of just how much might go to paying for existing debt and how much you might take into consideration spending to seek a more safe future.